All Categories

Featured

Table of Contents

At one time, people held the most bitcoin as an investment. The leading bitcoin financiers are no much longer people since exchanges, brokerage firms, and organizations have actually taken over as the largest bitcoin holders.

Bitcoin has been an organization passion for several years, but complying with the authorization of spot bitcoin ETFs in January 2024, services accounted for one of the most bitcoin held. Kinds of companies that hold bitcoin are broker agents, exchanges, company knowledge and analysis business, and endeavor capital teams. Bitcoin. While not a capitalist in the typical sense, Satoshi Nakamoto, the confidential Bitcoin creator, is rumored to hold one of the most bitcoin.

This plan guarantees that the exchange can recognize its dedication to ensuring the security of its consumer's possessions. One of the initial businesses to create investing items connected to bitcoin, Grayscale's Bitcoin Trust fund ETF (GBTC) is among the most preferred bitcoin investments besides bitcoin itself. On May 8, the ETF held 292,267.9983 BTC, permitting financiers direct accessibility to rate changes.

A Beginner’s Guide To Yield Farming In Defi

MicroStrategy proceeds acquiring bitcoin and held a total amount of concerning 214,400 bitcoins in May 2024. Companies are the greatest bitcoin financiers in 2024.

Bitcoin and cryptocurrencies are volatile investments yet numerous individuals spend greatly in them, wishing they will proceed surpassing previous highs and return a tidy earnings. While investing in bitcoin and various other cryptos can be testing for financiers unknown with the crypto world, brand-new methods of investing in bitcoin and various other cryptos have emerged, mostly in the type of exchange-traded funds (ETFs).

The comments, point of views, and evaluations revealed on Investopedia are for informational purposes only. Review our guarantee and responsibility please note for more info. As of the day this write-up was written, the writer owns BTC and LTC.

Cryptocurrencies are enabled by an innovation called blockchain, which serves as a digital journal for semi-anonymous digital deals. Bitcoin started with a worth of less than a dime, and at its historical high hit greater than $73,000. Considering that its creation, even more than 21,000 various cryptocurrencies have developed and adhered to in Bitcoin's footprints.

The Impact Of Bitcoin Halving On The Market

Terms are recorded on the blockchain. Really comparable to having traditional stocks, with the major distinction being registration on a blockchain versus a data source or paper certification as holds true with standard supply. Voting legal rights are additionally provided with these symbols via the blockchain. Tesla and PayPal are just 2 examples of business that can be gotten as regular shares and as tokenized supplies with the blockchain.

Bitcoin was meant to eliminate the control, oversight and costs connected with money transactions. The authenticity given by third-party institutions like banks was supposed to be replaced by cryptographic networks online. On Jan. 3, 2009, the very first blockchain was introduced with the initial "block" called the genesis block. Governance Tokens. The first actual purchase with Bitcoin occurred on May 22, 2010, when a Florida guy discussed to have two Papa John's pizzas worth $25 delivered in exchange for 10,000 bitcoins.

Followers have since called now "Bitcoin Pizza Day." In February 2011, Bitcoin's price passed the $1 threshold. About 13 years later on, Bitcoin hit an all-time high of $73,750 in March 2024. Given that Bitcoin's creation, even more than 21,000 various cryptocurrencies have actually been produced. Bitcoin is the most valuable coin in circulation, with Ethereum and Secure in 2nd and 3rd place, respectively.

Blockchain Use Cases Beyond Cryptocurrency

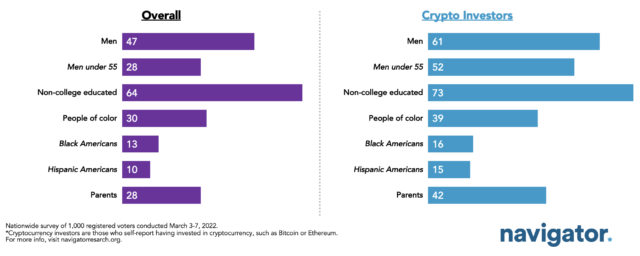

4, 2024), according to The international payments income is anticipated to cover $3 trillion by 2026, according to a McKinsey report. Since Sept. 4, 2024, the size of the Bitcoin blockchain is about 598 gigabytes, regarding 18 percent more than where it was one year ago. About 17 percent of American grownups have actually possessed cryptocurrency as of 2023, according to a Seat Proving ground study.

This ledger tracks each deal of cryptocurrency, and computers throughout the network confirm and refine each purchase through a blockchain database. Think about it like a lengthy invoice that tapes every transaction in a cryptocurrency. As transactions are refined and verified, new bitcoins are created, or mined. Mining is the procedure of including one more entry onto the invoice, or an additional block to the chain.

When cryptocurrencies were initial created, it was nearly impossible for government tax obligation companies to track them. The hallmark of blockchain transactions is anonymity, implying one could not prove the identification of the customer or the vendor. In 2014, the IRS stated that cryptocurrency was to be treated as building for government revenue tax objectives.

Best Practices For Crypto Security In 2024

Game streaming system Twitch accepts Bitcoin, Bitcoin Cash money and others as settlement. AMC theaters permit moviegoers to buy tickets with Bitcoin and other cryptos.

Crypto mining is the procedure of creating brand-new coins on a given blockchain such as Bitcoin's. Computer systems operating these decentralized blockchain networks solve complex mathematical issues to attempt to earn bitcoins., crypto exchanges such as Coinbase as well as a few typical brokerage firms such as Interactive Brokers.

Our team believe that cryptocurrencies and blockchain technology will certainly reinvent and reinvent lots of sectors, consisting of the economic one. You can already utilize various tokens and coins for various utilities like purchasing food, properties, and travel expenses. Keeping that in mind, it needs to be said that this is still a young sector which a great deal of people are in it totally for speculative financial investments.

Best Defi Platforms For Earning Passive Income

They most likely heard regarding Bitcoin in one of the most current bull markets, especially at the end of 2017. They often tend to lack the specific knowledge and experience, which is why they can usually be ignorant.

If they are fortunate and make a successful investment, they get extremely confident. In short, their sensations in the direction of cryptocurrencies fluctuate in rhythm with market conditions.

Latest Posts

The Impact Of Bitcoin Halving On The Market

Cryptocurrency Staking: A Guide To Earning Passive Income

How To Profit From Crypto Arbitrage Trading